Scaling an already successful home service business can be challenging. While the sector is massive (worth more than $500 billion in the United States as of writing), most cities have a handful of big players competing not just for customers but also qualified workers.

At Build Media Group, we’ve been helping home service businesses address this challenge using a variety of strategies. Keep reading as we walk you through one in particular: buying other home service companies within your vertical.

In this article, you’ll learn:

- Why acquiring additional home service businesses is the key to growing your empire

- The step-by-step process that makes this strategy work

- How to project your returns from a potential acquisition using our detailed model

Don’t panic, by the way. This strategy doesn’t require you to have millions of dollars in cash on hand. Buying a home service company is straightforward and accessible if you approach it systematically.

3 Reasons Acquisitions Are Such a Powerful Tool for Home Service Companies Looking to Grow

Before we walk you through the strategy itself, let’s explore why acquisitions are such a powerful growth tool for home service businesses.

Solve Labor Supply Issues Efficiently

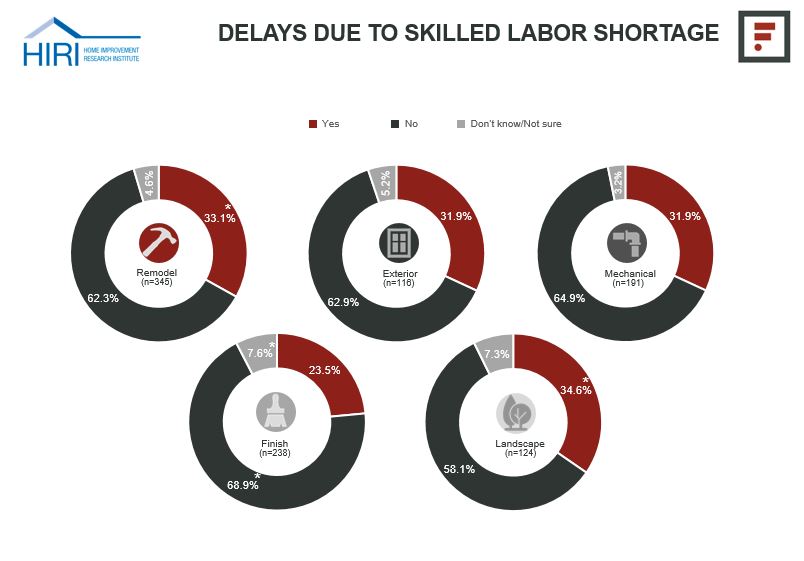

Even in relatively small cities, keeping up with the demand for home services can be tough. By acquiring other businesses, you can solve this and two additional underlying issues efficiently.

Number one is the difficulty of attracting qualified workers. Because many local home service companies are family-owned (or might as well be given their tight culture), poaching skilled laborers from your competitors often isn’t a very scalable solution. By acquiring the competition, however, you can bring dozens of new workers into your network at once without severely disrupting their sense of community.

The second underlying labor supply-related challenge you’ll solve by acquiring other home service companies is logistical. In geographically large cities, home service companies often waste hours of labor productivity every day thanks to workers stuck sitting in traffic en route to calls.

Smart scheduling and navigational systems can only help so much with this issue. Owning another company in a commonly-serviced part of town is a more efficient and long-term solution.

Expand Your Service Area Easily

Of course, the home service businesses you acquire don’t have to be within the same city as your existing company. In fact, buying businesses in other cities or even states is likely the simplest way to expand geographically.

After all, home service companies often require state-specific licensing to operate legally. You can bypass this red tape by acquiring an existing business and structuring the deal so it retains the necessary licensing even under new ownership.

Established Home Service Companies Are Often Primed for Growth Under New Leadership

In our experience working with hundreds of home service companies over the years, we’ve noticed some trends. Relevant to this point is the prevalence of businesses lacking clear procedures in key areas such as:

- Customer relationship management

- Employee scheduling

- Marketing

The issue is that (as you likely know) home service business owners often face so much demand they can’t (or don’t see the need to) step away from putting out fires long enough to establish strong systems.

With a fresh set of eyes, however, you can often step in and systematize a new home service company acquisition relatively easily – especially with the right team in place (which we can help with; see our previous point). This can unlock significant capital growth within a relatively short period.

Check out this case study to learn how we increased a Phoenix, Arizona-based HVAC company’s revenue by 32% within 12 months through systematized marketing strategies.

How to Scale Your Home Service Company Through Strategic Acquisitions

Step 1: Make Sure Your Existing Company’s Systems Are Strong

This first step is critical. Before you even think about acquiring additional home service companies, make sure your existing business is operating efficiently.

We like one of the benchmarks proposed in Home Service Millionaire by Tommy Mello. Your company’s processes for everything from managing customer relationships to sourcing new parts should be so tight the ship could stay afloat even without your involvement. Until you’ve reached that point, acquiring a new company will only add more tasks (and stress) to your plate.

In addition to Home Service Millionaire, we recommend reading Scaling Up by Verne Harnish for advice on systematizing your business.

For some rapid-fire systematization ideas, check out the video below from Tommy Mello:

Step 2: Look for Businesses in Your Vertical You’d Like to Buy

Once your existing home service business is systematized and you’re ready to buy another, begin looking at competitors nearby.

You’ll find the most value (from the perspective of scaling) in companies that occupy your vertical. In other words, if you’re an HVAC business owner, look for HVAC businesses. While you might be tempted to expand into, say, roofing, you’ll likely find yourself spread too thin while your direct competitors benefit from concentrating their efforts.

Step 3: Do Your Due Diligence and Identify Companies Worth Buying

Next, research your potential acquisitions thoroughly. Many entrepreneurs work with experienced market research firms on this. They’ll know how to access useful data that will inform your analysis.

Aim to identify however many companies you plan on buying.

Step 4: Price Your Potential Acquisition(s)

In this step, arrive at pricing estimates for the acquisitions you identified as being worthwhile in Step 3. This will help you begin securing financing.

There are many ways to value a small business. Check out this guide from NerdWallet for some strategies.

Step 5: Apply for Financing

In the United States, securing capital for an existing home service business acquisition is straightforward if you know how to leverage opportunities like the Small Business Administration’s (SBA) lending programs.

At Build Media Group, we’ve built strategic partnerships to streamline the SBA loan application process for our clients. Our partners can help you:

- Craft an effective SBA loan application

- Come up with a down payment for the company (our partners take a minority stake in every acquisition they facilitate, which will reduce the amount of money you have to come up with personally)

- Negotiate the purchase price

- Complete the purchase

Contact us for more information about acquiring businesses through SBA loans.

Step 6: After Acquiring a Business, Begin Systematizing It

Once you acquire a new business, begin applying the same systematization that makes your existing business a well-oiled machine. The goal is to make your acquisition an extension of your original business. Otherwise, you’ve merely bought more work for yourself.

As mentioned earlier, systematization is the key to unlocking explosive growth after acquiring a home service company. We’ve seen minor adjustments in areas such as customer relationship management and marketing deliver double-digit revenue growth within months.

You can then enjoy additional revenue and expand your network of home service companies further.

Projecting Your Returns from Acquiring an Existing Home Service Business

Throughout this article so far, we’ve mentioned the capital growth potential when it comes to buying a home service company. Next, let’s dive into some actual numbers using a financial model we’ve built to project your revenue and returns from acquiring a home service company.

To open the spreadsheet and follow along, click here. We’ll work through it sheet by sheet and explain what you need to fill out.

Important: Only edit the tan cells. Any cells that aren’t tan contain calculations.

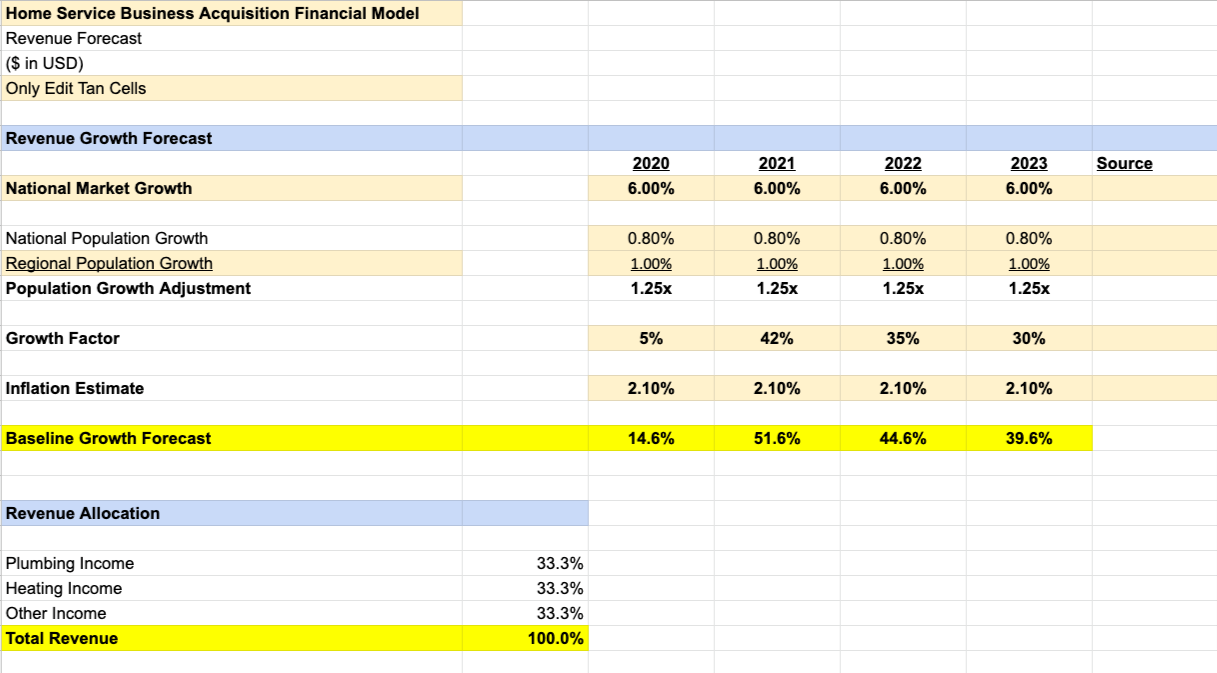

Sheet #1: Revenue Forecast

In this sheet, you’ll need to fill out the following fields:

- National Market Growth: Here, place the year-over-year national growth projections for your industry across the identified years. The U.S. Bureau of Labor Statistics is a good place to find this information. Use whatever data you have a high degree of confidence in.

- National Population Growth: In these fields, place the year-over-year population growth projections for the United States. By default, we’ve included numbers from the Statista Research Department but you can replace them with data from your own research if you’d like.

- Regional Population Growth: Here, place the year-over-year population growth projections for the geographic region you’d hypothetically buy a company in. For example, if you’d be looking to buy an HVAC company that services Chicago, use data for that specific city.

- Growth Factor: Enter your projected growth factor for the years identified in each column.

- Inflation Estimate: Input the national inflation rate forecast for the identified years. Here’s a good source you can use (or keep our default values in place).

- Revenue Allocation: Enter your hypothetical acquisition’s revenue streams and the percentage of the pie they take up.

- Revenue Forecast: Enter your prospective acquisition’s actual revenue for the indicated years.

- Seasonality Calculator: Use this month-by-month breakdown to indicate the percentage of your annual revenue generated in each month.

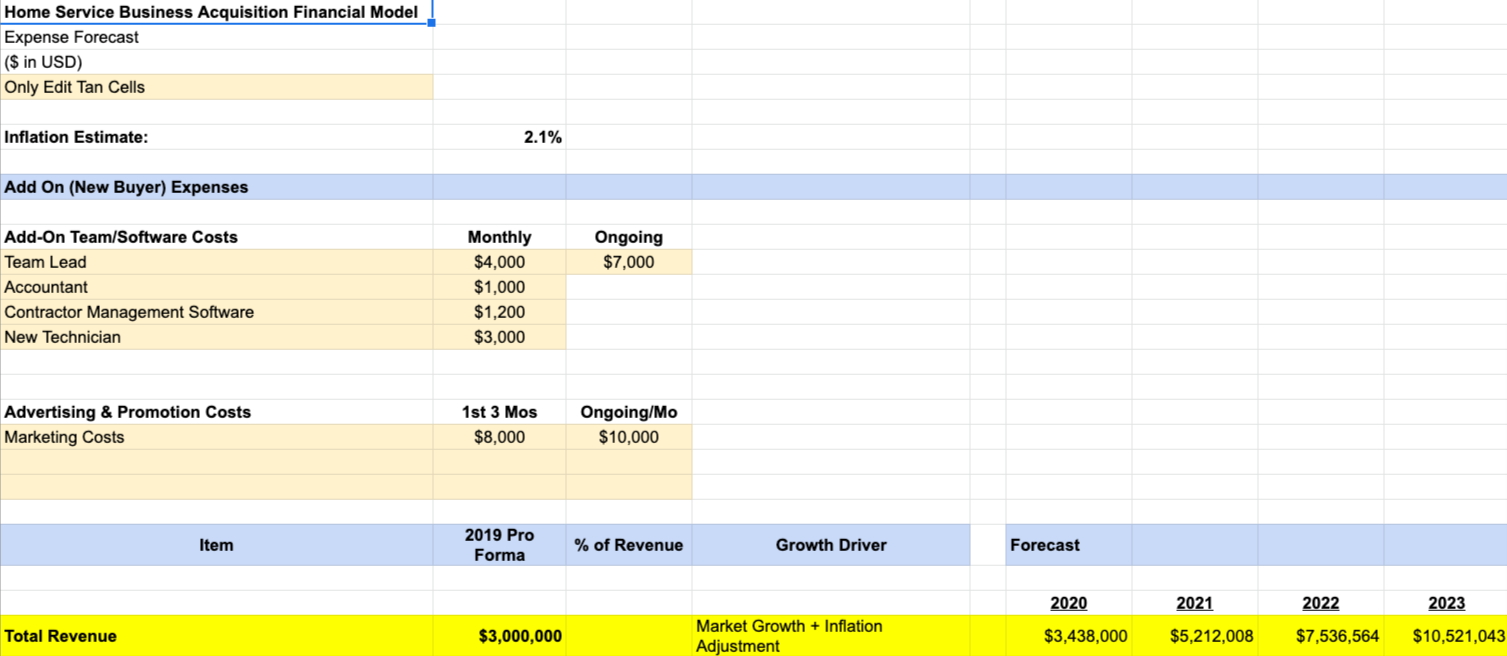

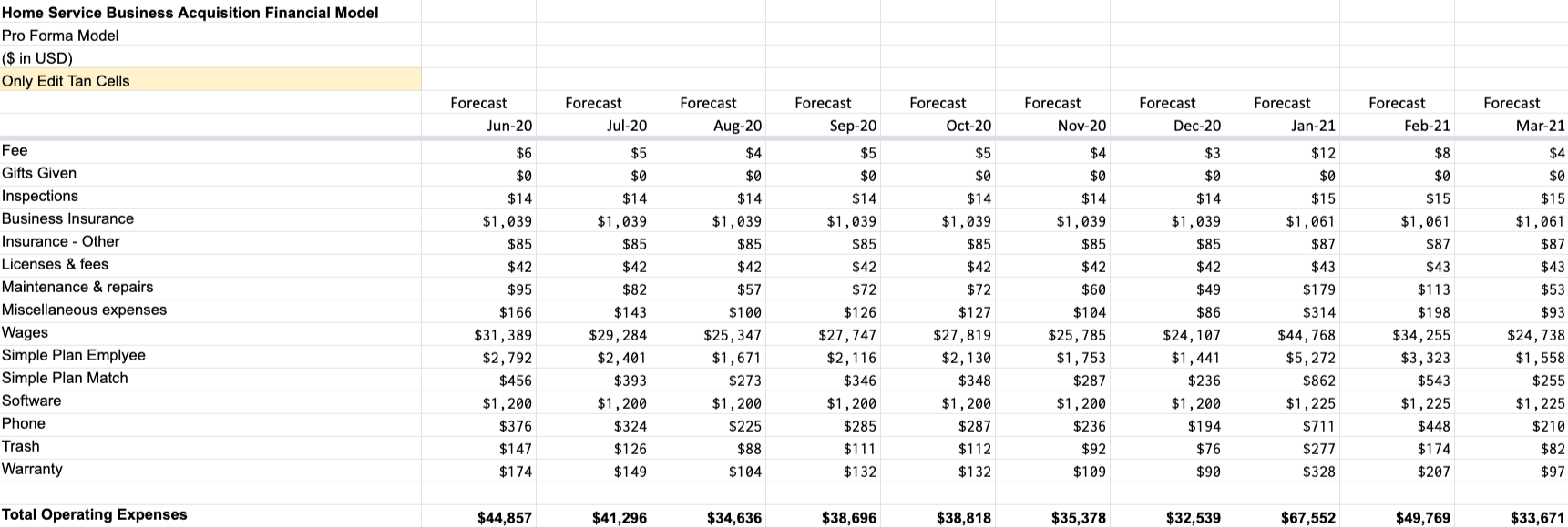

Sheet #2: Expense Forecast

In the second sheet of this workbook, you’ll need to fill out these sections:

- Add On (New Buyer) Expenses: Here’s where you’ll place additional costs you anticipate incurring as the company’s hypothetical new owner. We’ve placed default values in the model (Team Lead at $4,000 monthly, Accountant at $1,000, and so forth) but replace them with data that suits your own expectations.

- Historical Expenses: In this section, you’ll be filling out a line-by-line breakdown of your hypothetical acquisition’s operational costs (on a pro forma basis) during the year 2019. If you’re already in talks to buy the company, you’ll likely have this information. If not, use estimates based on your industry knowledge and experience.

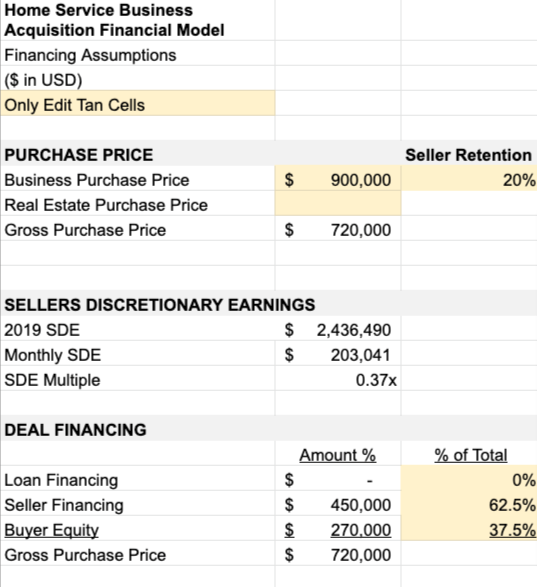

Sheet #3: Financing Assumptions

This third sheet is where you’ll place information regarding your plans to finance the acquisition. The fields you’ll need to fill out are:

- Business Purchase Price: Enter the projected purchase price for your hypothetical acquisition.

- Seller Retention: How much of the business will the seller retain? If you plan on owning the company outright, this will be 0%. But if they’ll retain a stake, reflect that here.

- Real Estate Purchase Price: Here, enter the expected price of any real estate you’ll be purchasing as part of the acquisition deal.

- Deal Financing: Under this section, replace the tan-colored fields (Loan Financing, Seller Financing, and Buyer Equity) using your own projected data. The numbers you input will represent the percentage of the deal you’ll be financing using that method.

- Loan Terms SBA: Here, fill out the “Period (Years)” and “Interest Rate” fields to indicate your hypothetical SBA loan terms.

- Loan Terms Seller Financing: Lastly for this sheet, fill out the “Interest Rate” field under this section to indicate the interest rate on any projected seller financing.

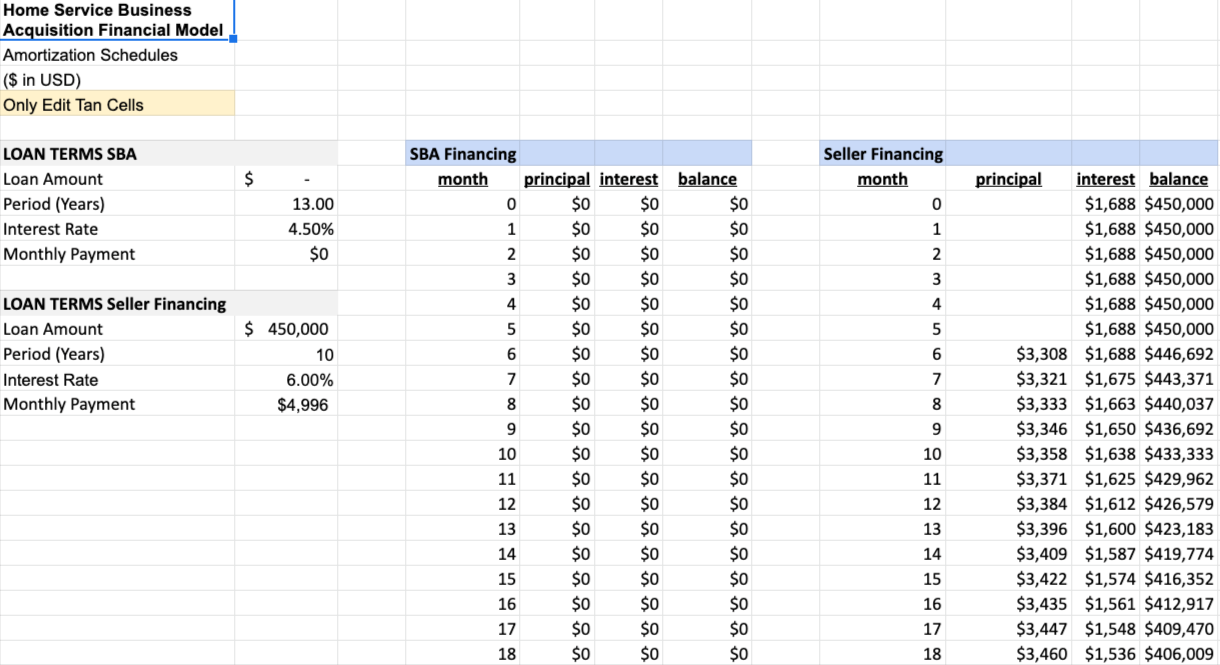

Sheet #4: Amortization Schedules

From this sheet onward, you don’t need to enter any new values. Rather, the fields will indicate financial projections based on your inputs in prior sheets.

Here’s a breakdown of what each component in this sheet means:

- Loan Terms SBA and Loan Terms Seller Financing: These two sections recap the loan terms you placed in the previous sheet and provide a hypothetical monthly payment.

- SBA Financing: This section breaks down your amortization schedule assuming you’re taking out an SBA loan. If you’re not, the values will be $0.

- Seller Financing: This section breaks down your seller financing amortization schedule. If you’re not using seller financing, these fields will contain $0.

Sheet #5: Pro-Forma Model

This sheet is straightforward, reflecting your projected revenue, cost of sales, gross profit, operating expenses, and adjusted operating income. It pulls data from the Revenue Forecast and Expense Forecast sheets to arrive at these projections.

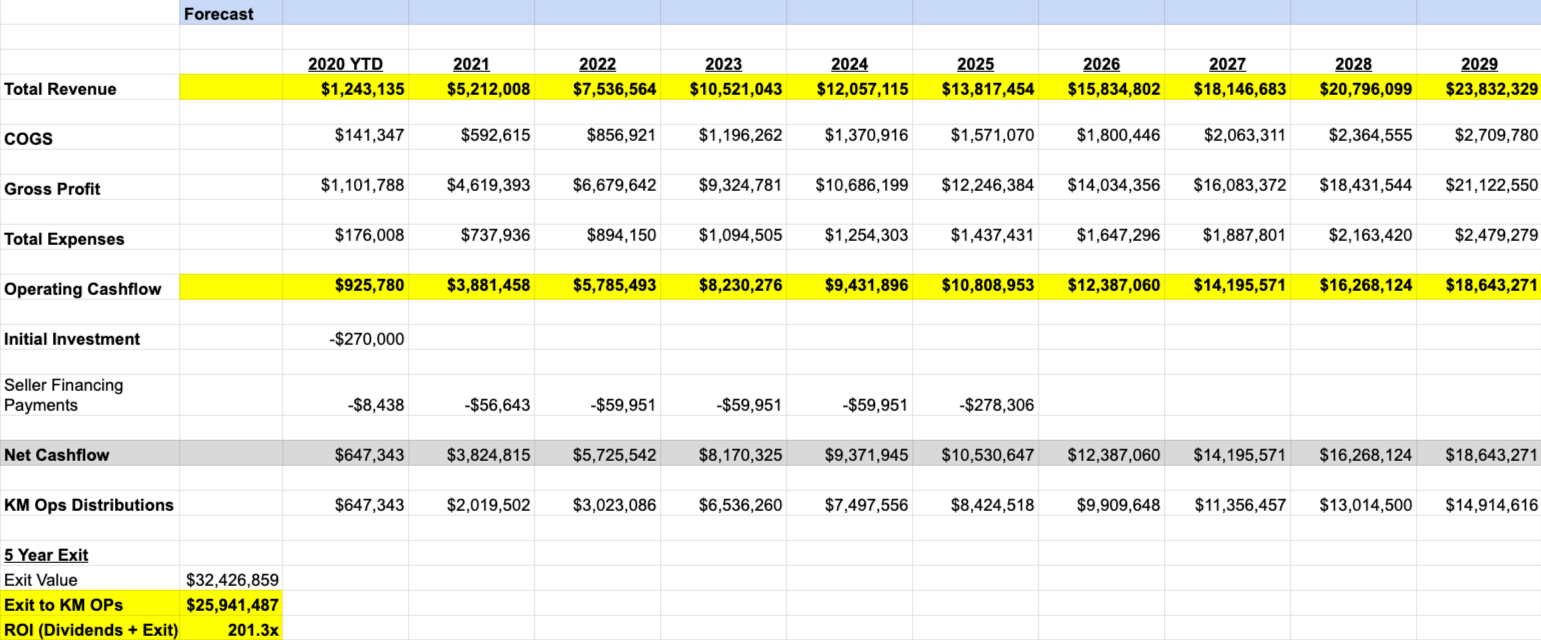

Sheet #6: Potential Returns

Lastly, this sheet projects your total revenue, operating cash flow, and net cash flow after accounting for financing payments and your initial investment in purchasing the company.

You’ll also find projections regarding the company’s value (and your ROI) were you to exit after five years of ownership.

What to Make of This Information

This model’s outputs will only be as accurate as your inputs. If you’ve used hypothetical numbers because you’re still merely mulling over buying a business (as opposed to working with real-world data), our model should still give you an idea of what to expect.

You can also use this model to reverse engineer the right acquisition deal based on what returns would be worth your while. Simply adjust the numbers in sheets one through three to evaluate different scenarios and see how they might impact the outcomes.

Conclusion

We hope this article has helped you see the benefits (and process) of acquiring additional home service businesses. If so, why not share it with someone in your network who could benefit from reading about these ideas as well?

We’re always looking to improve as well; feel free to drop any questions you might have regarding our financial model in the comments below.